Is the Art Market More Resilient Today?

Stephen Brooks leaves Phillips + Guillaume Cerutti makes the case for a decade's growth in art market stability + Another way of looking at market cycles

Welcome to Artelligence

This newsletter looking at market cycles and what makes the auction business more resilient today is for paid subscribers only. Subscriptions are $12 a month or $120 for a year. If you are a paid subscriber, sharing a newsletter on occasion is fine; consistently sharing paid content within your organization or with others is not.

For organizations: We offer group discounts of 30% for each subscription of two or more. Group subscriptions allow one person within an organization to manage all subscriptions. You may add new subscriptions at the discounted rate whenever you like; and, if an employee leaves, you may replace another employee in that seat. You may also move existing subscribers into the group. Create group subscriptions here.

There is also an option to get a 7-day free trial. Just choose the subscription plan you want and click on the 7-day trial option before checkout.

In This Issue

Stephen Brooks resigns from Phillips: The house will need to rebuild its narrative

Notes: Reading the newspaper doesn’t always make you smarter

For Paid Subscribers Only

Another way of looking at the market: What if the auction market works in three-year cycles and last year was the first year of a new cycle?

Is the market more resilient than it was 10 years ago? With the growth in luxury sales worldwide, the auction houses are operating in a more forgiving economic environment

Stephen Brooks Resigns from Phillips

It was revealed late last week in a German newspaper that Phillips CEO Stephen Brooks resigned from the auction house in December. Brooks had joined two years before to help Phillips grow and it appeared that he was on a path toward achieving his long-term goals. Well-liked by his staff, the departure is a surprise for the industry. and interrupts the narrative of Phillips’s continuing transformation into a third alternative auction house. Reclaiming that momentum now falls back into the hands of former CEO and current Chairman, Ed Dolman.

Notes

Casting stones: The news of Stephen Brooks’s resignation was first published in the German-language business newspaper Handelsblatt. It is unclear why the auction house did not announce the departure earlier. For some reason, that seems to have convinced Stefan Korbel, who writes an “annotated press review” for a German fine art insurance brokerage firm, of his own superiority to the press he gathers information from. Unfortunately, Korbel was not able “to do his own research” or even call Phillips for a statement. Because of that he erroneously suggested the departure was connected to Phillips better-than-its-peers sales volume drop. To make matters worse, the smug Korbel took an unnecessary swipe at the art press which only pointed to his own “copying” and “processing.” Here’s the item from Korbel’s newsletter:

“One likely victim of his auction house's disappointing sales is Stephen Brooks, who is no longer CEO of Phillips, as Stephanie Dieckvoss found out for Handelsblatt on Friday. It is not necessarily surprising that the head of the third-largest art auction house is taking his hat off after a 15 per cent crash (the latter fact reported by Artnews). What is surprising, however, is that none of the relevant organisations Artnews, Artnet or The Art Newspaper have noticed. Apparently, the three are so busy copying from each other or processing press releases that they have no time to monitor other media or even do their own research.” [Emphasis added]

Another Way of Looking at the Market

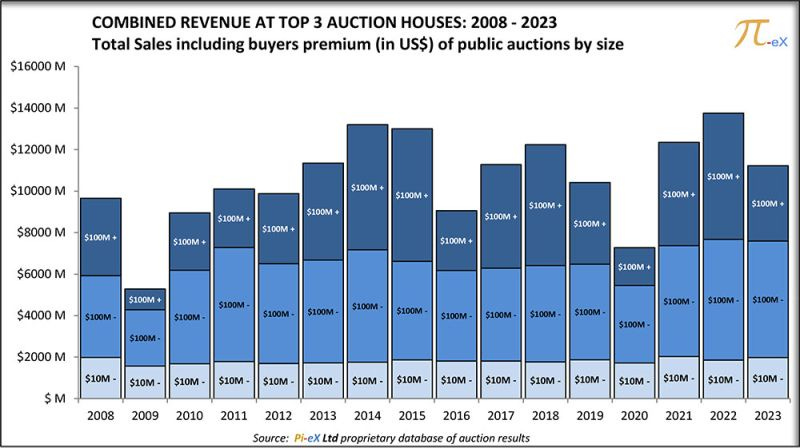

Christine Bourron, the founder of Pi-Ex, published this chart on LinkedIn to show how important the very top end of the art market is too its overall growth or yearly variation. The major event auctions that sell more than $100m in art in a single evening (it’s usually an evening event) are the most volatile end of the market. You can see that in the variation between the dark blue bars at the top of each yearly graph for the total combined sales of the top three auction houses over the last 16 years.

Seeing this chart reminded us of something entirely different. As almost everyone has commented, 2023 was a major drop in sales from the previous two years. The pullback has caused endless hang wringing and spurious comparison to 2009. Of course, the market pullback is nowhere near as severe as the reckoning during the global financial crisis.

What’s been overlooked is a common pattern in the market over the last decade and a half. The market tends to run in three-year cycles where sales volumes rise until estimates choke off demand. Removing the extraordinary years of 2009, because of the shock of the financial crisis, and 2020 because of the disruption from Covid-19, we can begin to describe the market in four distinct cycles. (We’ve annotated Pi-Ex’s chart to illustrate the pattern we’re describing.)

Keep reading with a 7-day free trial

Subscribe to Artelligence to keep reading this post and get 7 days of free access to the full post archives.